National Bank of Kentucky, Louisville, KY (Charter 5312)

National Bank of Kentucky, Louisville, KY (Chartered 1900 - Receivership 1930)

Town History

Louisville is the most populous city in the Commonwealth of Kentucky, sixth-most populous city in the Southeast, and the 27th-most-populous city in the United States. By land area, it is the country's 24th-largest city, although by population density, it is the 265th most dense city. Louisville is the historical county seat and, since 2003, the nominal seat of Jefferson County, on the Indiana border.

Named after King Louis XVI of France, Louisville was founded in 1778 by George Rogers Clark, making it one of the oldest cities west of the Appalachians. With the nearby Falls of the Ohio as the only major obstruction to river traffic between the upper Ohio River and the Gulf of Mexico, the settlement first grew as a portage site. It was the founding city of the Louisville and Nashville Railroad, which grew into a 6,000-mile system across 13 states.

Today, the city is known as the home of boxer Muhammad Ali, the Kentucky Derby, Kentucky Fried Chicken, the University of Louisville and its Cardinals, Louisville Slugger baseball bats, and Fortune 500 company Humana. Louisville Muhammad Ali International Airport, the city's main commercial airport, hosts UPS's worldwide hub.

Louisville had 18 National Banks chartered during the Bank Note Era, and all 18 of those banks issued National Bank Notes.

Bank History

- Organized April 23, 1900

- Chartered April 28, 1900

- Succeeded Bank of Kentucky

- Assumed 4956 (American-Southern National Bank of Louisville) and 9241 (National Bank of Commerce of Louisville) by consolidation February 3, 1919

- Assumed circulation of 4956 and 9241

- Receivership November 17, 1930

- Bank of Louisville Building, 322 West Main Street, Louisville, KY. Nine photos of the exterior and interior of the bank from the Library of Congress

Bank of Kentucky

The National Bank of Kentucky was organized in 1834. In 1837 a bank building was erected for the Louisville branch of the old Bank of the United States which was forced to go out of business when President Jackson vetoed the bill to re-charter the bank, the main institution of which was located in Philadelphia. The Bank of Kentucky was then organized and operated under a State charter until 1900 when it became a national bank. Probably no bank in the State had a more unusual or successful career. Mr. Oscar Fenley had been president since 1896. The presidents of the bank in order follows: John J. Jacob, W.H. Pope, Virgil McKnight, Henry Griswold, Thomas L. Barret, Henry W. Barret, John M. Atherton and Oscar Fenley who was elected president in 1896.[2] George Clark Gwathmey was the first cashier of the Bank of Kentucky.

William H. Pope attended and graduated from Harvard College, 1817-1821. He was an attorney and in 1832 he became president of the branch of the U.S. Bank, was the second president of the Bank of Kentucky, 1837-40, and president of W.H. Pope & Co., wholesaler. His home, known as Bonnycastle, was built in 1825/35 upon his father's estate on Bardstown Rd. His father was a member of the Kentucky House, 1809, and Kentucky Senate, 1810-14.

In February 1840, the following bill was read the third time and passed: An act to extend and continue in force an act approved 29th February 1836 entitled, an act extending for a certain time and with certain limitations, the charter of the old Bank of Kentucky.[3]

In August 1840, another counterfeit of the $5 bills of the Bank of Kentucky, payable at the Branch at Hopkinsville, to Jno. P. Campbell, president, or bearer, appeared. They were an excellent imitation, the signatures of G. Gwathmey, Cashier and W.H. Pope, President, were a very close copy, detectable only by persons well-acquainted with the real signautes.[4]

In August 1850, the funeral of G.C. Gwathney took place in his late residence on Main Street over the Bank of Kentucky. He died on August 3rd and was buried in Cave Hill Cemetery in Louisville.[5] On the 13th, S.Harr Bullen, Esq., was appointed cashier of the Bank of Kentucky in place of Mr. Gwathmey.[6][7] Mr. Bullen had long filled the post of principal teller in the bank with great credit and brings to his new post much experience , an intelligent and well-cultivated mind, and a pleasing address. Mr. Jno. T. Sanders who had been specie teller in the bank for some years was elected principal teller in Mr. Bullen's place.[8]

The statement of the Bank of Kentucky and its branches as of January 1, 1862, showed total resources of $4,986,319.23, with capital stock $3,700,000 less 226 shares cancelled $22,600, surplus $639,480.69 and circulation $1,185,732.00. The branches at Bowling Green, Hopkinsville, and Columbus had been for several months within the lines occupied by the army of the Southern Confederacy and no satisfactory report of their condition was available.[9] On May 26, 1862, S.H. Bullen, Esq., of Louisville and late cashier of the branch of the Bank of Kentucky at Louisville died at Memphis. The deceased had enjoyed the esteem and confidence of his fellow citizens throughout a long and useful life.[10]

On December 30, 1872, Henry A. Griswold, president of the Bank of Kentucky died in a room in the bank building. He was born in Rhode Island in 1811, the son of Bishop Alexander Viets Griswold. He came to Kentucky in 1829, In 1834 he resided in Lexington and was a teacher in Rev. B.O. Pears' Institute [later Transylvania University at Lexington]. He later moved to Louisville and after teaching school for a few years became the partner of Mr. John P. Morton in the publishing business, in which he remained until 1857. He was elected Director in The Bank of Kentucky in 1858, acting as Cashier pro tempore. In May 1871 he succeeded Virgil McKnight, Esq., to the presidency and engaged actively in the duties of his office until the day of his death.[11]

On Monday, May 6, 1889, at the annual meeting of the stockholders of the Bank of Kentucky, the following Board of Directors was elected: Thos. L. Barret, Henry W. Barret, John M. Atherton, A. Hite Barret, W.H. Dulaney, John A. Carter, John K. Goodloe, H.M. Griswold, and George W. Morris.[12] Thomas L. Barret was president and also treasurer of the Mutual Life Insurance Co. of Kentucky, the only regular life insurance company organized under the laws of the State of Kentucky in 1866.[13]

On Friday, July 24, 1896, Mr. Henry W. Barret resigned from the presidency of the Bank of Kentucky and Mr. John M. Atherton was elected president to succeed him, and Mr. Oscar Fenley was elected vice president. He resigned to devote time to the Henry W. Barret Co., owners and operators of the Eclipse Woolen Mills. He had been in the office only a few weeks having succeeded his brother, the late Thomas L. Barret, under whom he was vice president. Mr. Atherton was for many years a director of the bank and head of the big whisky firm of J.M. Atherton & Co. Mr. Oscar Fenley was the cashier of the Citizens National Bank and possessed a full knowledge of the business. He was forty years of age and had spent 25 years with the Citizens National, starting as a clerk and rising rapidly and steadily with a high standing in the local business world. Mr. Atherton proposed to devote considerable time and attention to the bank, leaving most of the active management in the hands of Mr. Fenley. The latter would spend several days closing his affairs with the Citizens National.[14]

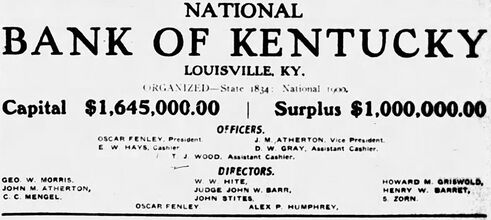

On Monday, May 1, 1899, the stockholders of the Bank of Kentucky met and elected directors for the ensuing year. Two changes were made in the directory which had been composed of the same gentlemen for years. Charles C. Mengel, Jr., was chosen to succeed A. Hite Barret, and Sebastian Zorn was elected in place of W.H. Dulaney. Messrs. Barret and Dulaney refused to stand for re-election on the grounds that their private affairs demanded all their attention. The other directors were re-elected as follows: John M. Atherton, Henry W. Barret, John W. Barr, Jr., Howard M. Griswold, W.W. Hite, Alex. P. Humphrey, George W. Morris, John Stites, and Oscar Fenley. The directors subsequently met and re-elected the old officers. They were Oscar Fenley, president; J.M. Atherton, vice president; E.W. Hays, cashier; D.W. Gray and Thomas J. Wood, assistant cashiers.[15]

In January 1900, a bill in the Kentucky Legislature sought to repeal the charter of the Bank of Kentucky. Mr. Oscar Fenley, president of the Bank of Kentucky said the bank would fight it if it passed. "The charter has ten years yet to run," he said. "The Supreme Court has decided that the bank has a contract with the State by means of which we pay taxes under the Hewitt Law. We have complied with the law and have vindicated our position through the State courts and the Supreme Court. I think we are entitled now to rest, but if the bill becomes a law, we shall have to appeal to the courts again." The Bank of Kentucky had an old and valuable charter which gave it exceptional privileges, but after the Hewitt Law was passed, the bank accepted its provisions, reserving its ancient rights. The bank prevailed on litigation during the last few years. The Bank of Kentucky paid state taxes along with the Farmers' Bank and Deposit Bank at Frankfort under the Hewitt Law, and the object of the bill was to require payment of city taxes like other banks.[16] In March 1900, the officers of the Bank of Kentucky issued a circular calling for a stockholders' meeting to be held on Monday, April 23rd to decide whether the bank should be merged into a national bank or go into liquidation. The Rennick Bill which was recently signed by Gov. Beckham, compelled the bank to pay state taxes like other banks or have its charter repealed. If the stockholders decided to make the Bank of Kentucky a national bank, the Comptroller of the Currency would be asked to allow the bank to retain its name with the words "National Banking Association" added. While a national bank was not exempt from any taxes, it would have more privileges than a State bank. The Bank of Kentucky was one of the model banking institutions in the South and during its long existence had been of much public service. It had been a tower of strength in financial circles and had withstood all panics. It had come to the rescue of the State on several occasions and at one time the State was indebted to it in the sum of $500,000. Its current charter had nine years left to run. According to Col. Thomas Rodman, president of the Farmers' Bank of Kentucky, his bank would go into liquidation as a result of the legislative action repealing its charter unless taxes were paid at the same rate as other banks.[17] In April, Mr. Fenley left for New York for the purpose of purchasing Government bonds necessary before the bank could be placed on a national basis. He would purchase the new 2 per cent issue, but it was unknown just how many he would get. It was clear a majority of stockholders were in favor of the national bank.[18]

The National Bank of Kentucky of Louisville

On Wednesday, April 18, 1900, the application to convert the Bank of Kentucky, Louisville, to The National Bank of Kentucky of Louisville, capital $1,645,000, was approved.[19] The stockholders voted Monday to convert the bank into a national bank. While a little awkward, this name was the best the bank could do to preserve its old and honored name under the new order of things.[20] On April 28th, the Comptroller of the Currency issued certificates authorizing the following Kentucky National Banks to begin business: The National Bank of Kentucky of Louisville with $1,645,000 capital, Oscar Fenley, president; E.W. Hays, cashier; and The Grayson County National Bank of Leitchfield (Charter 5314) with $25,000 capital, John A. Bishop, president; E.R. Bassett, cashier.[21]

On Friday, January 11, 1901, the board of directors of the National Bank of Kentucky held its annual meeting and elected officers as follows: Oscar Fenley, president; J.M. Atherton, vice president; E.W. Hays, cashier; D.W. Gray and T.J. Wood, assistant cashiers.[22]

In December 1905, the directors were Geo. W. Morris, W.W. Hite, Howard M. Griswold, John M. Atherton, Judge John W. Barr, Henry W. Barret, C.C. Mengel, John Statis, S. Zorn, Oscar Fenley, and Alex P. Humphrey. The officers were Oscar Fenley, president; J.M. Atherton, vice president; E.W. Hays, cashier; D.W. Gray and T.J. Wood, assistant cashiers. The bank had capital $1,645,000 and surplus $1,000,000.[23]

In January 1918, the directors were John M. Atherton, vice president; John W. Barr, Jr., president, Fidelity & Columbia Trust Co.; Henry W. Barret; Oscar Fenley, president; A.T. Hert, president, American creosoting Co.; Allen R. Hite; Alex P. Humphrey of Humphrey, Middleton & Humphrey, attorneys; George J. Long, vice president, U.S. Cast Iron Pipe & Foundry Co.; C.C. Mengel, president, Mengel Box Co. and vice president C.C. Mengel & Bro. Co.; John Stites, president, Louisville Trust Co.; S. Zorn of S. Zorn & Co. The officers were Oscar Fenley, president; J.M. Atherton, vice president; H.D. Ormsby, vice president and cashier; D.W. Gray and Edward E. Lee, assistant cashiers. The bank reported total assets as of the close of 1917 at $14,599,323.14, with capital stock $1,645,000, surplus and profits $1,562,852.38, circulation $1,632,600, and deposits $9,413,015.59.[24]

On Tuesday, November 19, 1918, announcement was made of the consolidation of the National Bank of Commerce and the National Bank of Kentucky, two of Louisville's largest financial institutions, one of which was said to be the oldest south of the Ohio River, and the other with an almost meteoric rise to prominence and financial success. The consolidation would give Louisville one of the strongest banking houses in the entire South with resources of $36 million. The bank would occupy the quarters of the National Bank of Commerce at Fifth and Market Streets. This building was completed recently by the German Bank at a cost of $250,000. Negotiations for the merger were conducted by Oscar Fenley and John W. Barr for the Bank of Kentucky and James B. Brown and George W. Norton for the Bank of Commerce. The plan agreed upon was that the Bank of Kentucky put $1 million of its capital into the new bank, distributing the remaining $650,000 among its stockholders in cash at a rate of about $60 per share. The surplus of the bank would be retained. The Bank of Commerce would contribute $1 million of stock and get an equal amount of stock in return. Upon completion of the merger, the building occupied by the National Bank of Kentucky would be vacant and disposed of in some way. This building had the record of being the oldest and most historic bank building in Kentucky, having been built about 90 years ago and occupied by the Bank of Kentucky. The National Bank of Kentucky was organized in 1834. The present bank building was erected for the Louisville branch of the old Bank of the United States which was forced to go out of business when President Jackson vetoed the bill to re-charter the bank, the main institution of which was located in Philadelphia. The Bank of Kentucky was then organized and operated under a State charter until 1900 when it became a national bank. Probably no bank in the State had a more unusual or successful career. Mr. Oscar Fenley had been president since 1896.[25]

On Wednesday afternoon, November 27, 1918, the American-Southern National Bank directors voted to recommend their bank merge with the National Bank of Kentucky. This was just a few days since the announcement was made that the National Bank of Kentucky and the National Bank of Commerce would merge. The resultant bank would be one of the largest in the South with capital stock of $2,500,000 and a surplus of an equal amount. Of this, the American-Southern would contribute $500,000 of the capital and the same amount to surplus. The Bank of Kentucky and the Bank of Commerce would each have a million of capital and a million of surplus in the big bank. The deposits were variously estimated at from $30 million to $40 million, making one of the most powerful banking institutions in the South.[26] The American-Southern was a combination of the Southern National and the American National three years ago, accomplished by Earl Gwin who made a successful, progressive bank of the institution over which he presided. The National Bank of Commerce had already absorbed what for many years had been known as the German Bank. The new bank would move to Fifth and Market Streets into the building recently erected by the German Bank and occupied by the National Bank of Commerce. That would leave just one financial institution on Main Street, the Fidelity & Columbia Trust Company which also recently had been involved in an association plan including the Citizens National and Union National banks.[27]

On February 3, 1919, the National Bank of Kentucky of Louisville had total resources of $52,567,554.51 with capital stock $2,500,000, surplus and undivided profits $2,515,125.54, circulation $2,500,000, total deposits $43,987,449.44. Oscar Fenley was chairman of the board; James B. Brown, president; Earl S. Gwin, senior vice president; H.J. Angermeier, Henry D. Ormsby, Frank I. Dugan, E.B. Robertson, Henry Thiemann, C.M.S. Hebel, Noel Rush, John S. Akers, and N.H. Dosker, vice presidents; James J. Hayes, vice president and cashier; H. Lee Earley, auditor; and Flavie C. Adams, manager, new business dept. The following were the assistant cashiers and their responsibilities: Charles F. Jones, general banking dept.; H.R. Grant, discount dept.; David W. Gray, collateral; Noland B. Milton, collections; Thomas Green, in charge of tellers; Oscar A. Block, savings dept.; A.P. Ramser, transit dept.; Edward E. Lee, clearing division; Logan L. Fontaine, in charge of individual bookkeepers; and F.L. Moseley, discount dept.[28]

On Tuesday, January 13, 1925, stockholders elected the following directors: John M. Atherton, James B. Brown, R. Lee Callahan, Anthony J. Carroll, George M. Clark, Samuel W. Coons, Stuart E. Duncan, Joseph H. Durham, Oscar Fenley, Baylor O. Hickman, Allen R. Hite, Alexander P. Humphrey, Saunders P. Jones, Brainard Lemon, Charles C. Mengel, Thomas J. Minary, Edward J. O'Brien, Richard S. Reynolds, William S. Speed, Anthony V. Thomson, Henry Vogt, and John H. Wilkes.[29]

In January 1930, James B. Brown acquired the stock of Richard P. Ernst, former U.S. Senator, in the Peoples-Liberty Bank & Trust Co., Covington. Peoples Liberty absorbed the Liberty National Bank (Charter 1847) in March 1928. Brown was president of the National Bank of Kentucky and the BancoKentucky, banking corporations with resources in excess of $2,000,000. The senator was president of the Covington bank. The deal gave Brown and L.B. Wilson of Covington control of the Covington bank. Wilson who had been executive vice president, was elected president at a meeting of the directors on Friday. Several months ago Brown purchased for the BancoKentucky a large block of stock in the Central Savings Bank and Trust Co., Covington. It was believed this bank would be merged with Peoples-Liberty and become a branch of the larger bank. In this event the Peoples-Liberty would be the largest banking institution in Kentucky outside of Louisville with total resources of $12,000,000. Recently the Pearl Market and Brighton Banks of Cincinnati became affiliated with the BancoKentucky chain. The two Covington institution's alliance with the BancoKentucky and the Cincinnati banks would place the former in a much better condition to encourage capital investment for new industries and business enterprises in Northern Kentucky.[30]

On January 17, 1930, at the annual meeting of directors of the National Bank of Kentucky, James B. Brown was re-elected president, Charles F. Jones, for many years cashier of that institution, was elected vice president; and W.T. Zurschmiede, auditor, was promoted to cashier. Brown also was president of the BankcoKentucky Company which owned the National Bank of Kentucky, Louisville Trust Co., Pearl Market Bank and Trust Co., and the Brighton Bank and Trust Co., Cincinniati; and the Central Savings Bank and Trust Co., Covington, Kentucky.[31]

On Monday, November 17, 1930, after 96 years of operation, the National Bank of Kentucky, Louisville's largest banking institution, failed to open its doors, its affairs having been placed in the Russel E. Mooney, national bank examiner. Paul Keyes of the controller general's office at Washington was appointed receiver. The Louisville Trust Company, solvent in the opinion of its directors was placed in the hands of O.S. Denny, State Banking Commissioner, because of its affiliated operation with the National Bank of Kentucky. The Security Bank, Preston and Market Streets, affiliated with the National Bank of Kentucky, also failed to open its doors for business. The Louisville Trust Co. and the Security bank were affiliated through the BancoKentucky holding company. Their directors said the institutions were solvent and that the action was precautionary on account of the relationship with the National Bank of Kentucky. The Bank of St. Helens, a suburb, closed also as a precaution as did two small banks, the American Mutual Savings Bank and the First Standard Bank which cleared through the Louisville Trust Co. Louisville reacted to the situation philosophically. Some of the banks did more than the normal volume of business during the day, but there was nothing approaching a run at any of the banks. Policemen were stationed in front of the National Bank of Kentucky and the Louisville Trust Co. where small crowds gathered.[32]

On February 27, 1931, James B. Brown, president of the National Bank of Kentucky and former president of the BancoKentucky, and W.T. Zurschmieda, secretary-treasurer of BancoKentucky, were indicted on charges of embezzlement by the Jefferson County grand jury. Charles F. Jones of the National Bank of Kentucky was also indicted on an embezzlement charge. Brown was changed with embezzling $2,000,000 of BancoKentucky funds.[33]

All Federal indictments against James B. Brown were set for trial on January 11, 1932. The cases were indefinitely continued on October 26 when Arthur B. Bensinger, attorney for Brown, announced ready. Four indictments charged Brown with conspiring with Rogers Caldwell and Charles F. Jones to misappropriate $1,000,000; another alleged misappropriation of $46,000; a third charged improper diversion of funds to the old Herald-Post; and a fourth accused Brown of falsifying a report to the Comptroller of the Currency.[34] On Monday October 24, 1932, the indictments against James B. Brown and Charles F. Jones of the National Bank of Kentucky, and against Rogers Coldwell, Nashville, were dismissed by the Federal Court of Louisville as it began its fall session. United States District Attorney Thomas J. Sparks asked for nullification of the charges because of lack of proof.[35]

On January 10, 1934, James B. Brown and Charles F. Jones were acquitted on a directed verdict in Federal Court after a two day trial. The acquittal disposed of all pending charges against the two resulting from the failure of the National Bank of Kentucky.[36] They were charged with misapplication of $55,000 in a loan to Wakefield & Co., brokerage firm, by exceeding the bank's legal loan limit. Records showed the loan was made when the defendants were indebted to the bank by about $1,379,000 and that this was in excess of the bank's legal loan limit of $600,000. Also indicted was Mrs. A.E. Latta, head of the Wakefield company which was dismissed at the start of proceedings on January 8th. Among the witness summoned were A.M. Anderson, receiver; W.T. Zurschmieda, former cashier of the bank and at the time aiding in the liquidation of Detroit banks; Hugo A. White, Detroit accountant; Frank I. Dugan, president of the Security Bank; James J. Hayes, former vice president of the National Bank of Kentucky; J. Marcus Greer, Louise I. Harris, and Fannie G. Schweitzer, employees of Mrs. Latta.[37]

Official Bank Title

1: The National Bank of Kentucky of Louisville, KY

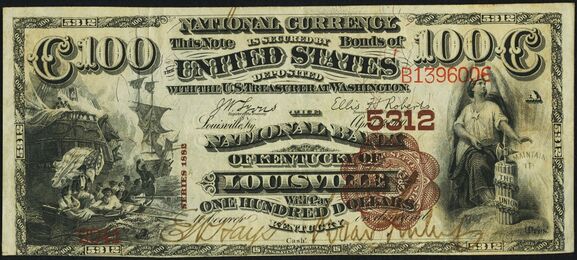

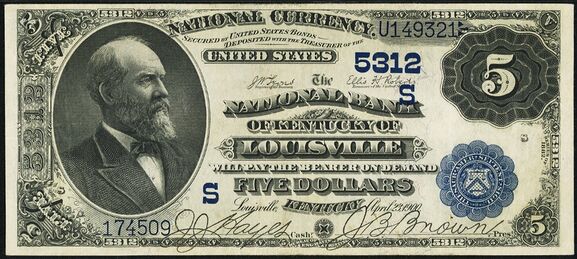

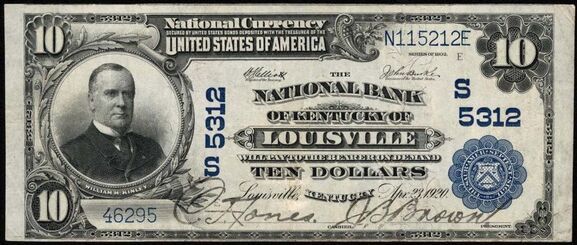

Bank Note Types Issued

A total of $36,869,760 in National Bank Notes was issued by this bank between 1900 and 1930. This consisted of a total of 4,521,382 notes (4,088,914 large size and 432,468 small size notes).

This bank issued the following Types and Denominations of bank notes:

Huntoon, Peter, Chapter E4, 1882 NBN Value Back Face Plates without “or other securities”, Encyclopedia of U. S. National Bank NotesSeries/Type Sheet/Denoms Serial#s Sheet Comments 1882 Brown Back 4x5 1 - 94000 1882 Brown Back 3x10-20 1 - 50200 1882 Brown Back 50-100 1 - 5633 1882 Date Back 4x5 1 - 115200 1882 Date Back 3x10-20 1 - 64170 1882 Date Back 50-100 1 - 1600 1882 Date Back 3x50-100 1 - 2000 1882 Value Back 4x5 115201 - 187677 1882 Value Back 3x10-20 64171 - 100820 QRST plate with "secured by United States Bonds Deposited with the Treasurer ..." 1902 Plain Back 4x5 1 - 351933 1902 Plain Back 3x10-20 1 - 231982 1929 Type 1 6x5 1 - 43491 1929 Type 1 6x10 1 - 21211 1929 Type 1 6x20 1 - 7376

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1900 - 1930):

Presidents:

Cashiers:

- Edwin Willison Hays, 1900-1906

- Henry Dumesnil Ormsby, 1907-1918

- James John Hayes, 1919-1919

- Charles F. Jones, 1920-1929

- W. T. Zurschmiede, 1930-1930

Other Known Bank Note Signers

- John Shelley Akers, Sr., VP 1919...1930

- Earl Stimson Gwin, VP 1919

- Henry Thiemann, VP 1919

- Eugene Beverly Robertson, VP 1919

Bank Note History Links

Sources

- Louisville, KY, on Wikipedia

- Bank of Louisville Building, 322 West Main Street, Louisville, Jefferson County, KY. Nine photos of the exterior and interior of the bank from the Historic American Buildings Survey Library of Congress), accessed Nov. 27, 2025.

- Photograph, Kentucky Historical Society, Historic American Buildings Survey Photographs, Graphic 23. Exterior front view of National Bank of Kentucky of Louisville, Jefferson County, KY. The Bank of Kentucky building was designed in 1837 by James H. Dakin for the United States' Bank of Louisville with two Ionic columns and a cornice with an iron palmetto crest.

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Louisville Herald, Louisville, KY, Sun., Dec. 31, 1905.

- ↑ The Courier-Journal, Louisville, KY, Wed., Nov. 20, 1918.

- ↑ The Commonwealth, Frankfort, KY, Tue., Feb. 4, 1840.

- ↑ The Courier-Journal, Louisville, KY, Sat., Aug. 22, 1840.

- ↑ The Louisville Daily Courier, Louisville, KY, Tue., Aug. 6, 1850.

- ↑ The Frankfort Commonwealth, Frankfort, KY, Tue., Aug. 20, 1850.

- ↑ New Orleans Weekly Delta, New Orleans, LA, Mon., Aug. 26, 1850.

- ↑ The Louisville Daily Courier, Louisville, KY, Wed., Aug. 14, 1850.

- ↑ The Courier-Journal, Louisville, KY, Mon., Feb. 10, 1862.

- ↑ The Courier-Journal, Louisville, KY, Thu., June 5, 1862.

- ↑ Weekly Louisville Commercial, Louisville, KY, Wed., Jan. 1, 1873.

- ↑ The Courier-Journal, Louisville, KY, Tue., May 7, 1889.

- ↑ The Courier-Journal, Louisville, KY, Sat., May 18, 1889.

- ↑ The Courier-Journal, Louisville, KY, Sat., July 25, 1896.

- ↑ The Courier-Journal, Louisville, KY, Tue., May 2, 1899.

- ↑ The Courier-Journal, Louisville, KY, Wed., Jan. 31, 1900.

- ↑ The Courier-Journal, Louisville, KY, Sat., Mar. 24, 1900.

- ↑ The Courier-Journal, Louisville, KY, Thu., Apr. 12, 1900.

- ↑ The Wall Street Journal, New York, NY, Wed., Apr. 18, 1900.

- ↑ The Courier-Journal, Louisville, KY, Sat., Apr. 21, 1900.

- ↑ The Courier-Journal, Louisville, KY, Sun., Apr. 29, 1900.

- ↑ The Courier-Journal, Louisville, KY, Sat., Jan. 12, 1901.

- ↑ The Louisville Herald, Louisville, KY, Sun., Dec. 31, 1905.

- ↑ The Courier-Journal, Louisville, KY, Thu., Jan. 1, 1918.

- ↑ The Courier-Journal, Louisville, KY, Wed., Nov. 20, 1918.

- ↑ The Courier-Journal, Louisville, KY, Mon., Dec. 2, 1918.

- ↑ The Courier-Journal, Louisville, KY, Thu., Nov 28, 1918.

- ↑ The Indianapolis Star, Indianapolis, IN, Wed., Feb. 5, 1919.

- ↑ The Courier-Journal, Louisville, KY, Wed., Jan. 14, 1925.

- ↑ The Cincinnati Post, Cincinnati, OH, Fri., Jan. 3, 1930.

- ↑ The Cincinnati Enquirer, Cincinnati, OH, Sat., Jan. 18, 1930.

- ↑ The Oldham Era, La Grange, KY, Fri., Nov. 21, 1930.

- ↑ Corsicana Daily Sun, Corsicana, TX, Fri., Feb. 27, 1931.

- ↑ The Kentuckian-Citizen, Paris, KY, Wed., Dec. 16, 1931.

- ↑ The Kentuckian-Citizen, Paris, KY, Wed., Oct. 26, 1932.

- ↑ The Daily Independent, Maysville, KY, Thu., Jan. 11, 1934.

- ↑ The Courier-Journal, Louisville, KY, Tue., Jan. 9, 1934.